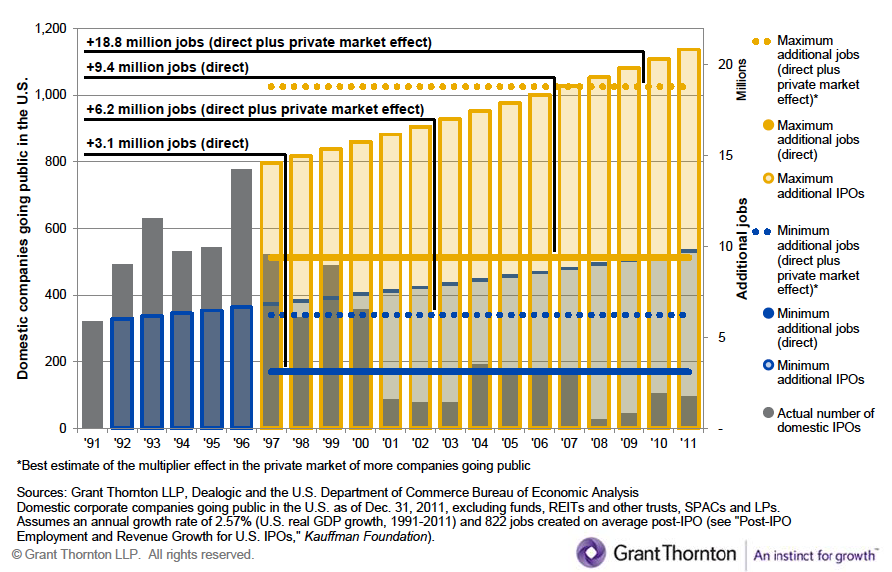

Cringely makes a compelling argument that stock market decimilization (allowing shares to be traded to the penny) is the primary cause of the sustained IPO crash in the US since 2000. His article is based on a presentation by David Weild. What’s compelling about this argument is that it gives a more tangible result to the suspected evils of computer generated rapid trading, enabled by this decimilization move. It’s not just that Wall Street has been leaching money from the system (acting as a small friction force), the effect of this regulatory change has (potentially) been to impair the development and creation of new companies.

Wealth creation is just as important as job creation in our economy but too many experts get it wrong when they think wealth creation and wealth preservation are the same things, because they aren’t.

via Ticked off: How stock market decimalization killed IPOs and ruined our economy ~ I, Cringely.

Update: See also the nice article in Wired last month about the lengths Wall Street firms will go to to get a microsecond edge (for the purpose of rapid trading). I’m trying to think of other examples of massive industries that have limitless capital investment capability yet serve no real use to society…

Update 2: So Cringely’s solution is have more IPOs in Hong Kong? That reminds me of the “let’s just let people get drugs from Canada” idea. It doesn’t solve our country’s problem. Pretty disappointing after a good analysis.